- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Catamarans

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Lekker Boats

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- MJM Yachts

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Numarine Yachts

- Ocean Alexander Yachts

- Offshore Yachts

- Outer Reef

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

April Brokerage Boat Sales Report

May 18, 2016 1:38 pm

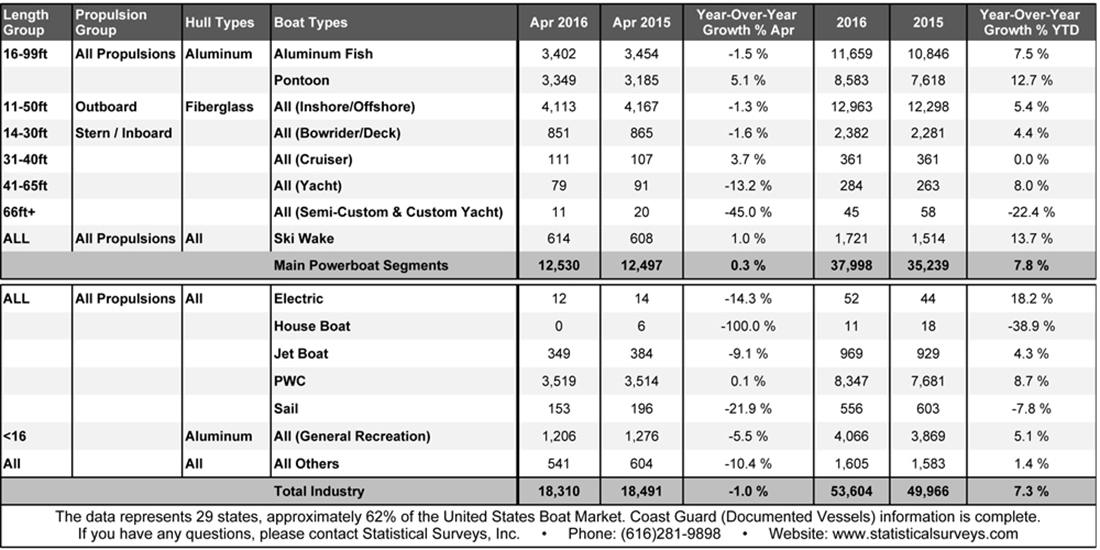

Brokerage boat sales for the month of April saw a decrease. Boat sales in the main powerboat segments rose just 0.3 percent to 12,530 and industrywide sales actually fell 1 percent to 18,310 from the same month last year in 29 early-reporting states that represent about 62 percent of the national market.

For perspective, sales through April in those states are up 7.8 percent at 37,998 in the main segments and 7.3 percent industrywide at 53,604.

Statistical Surveys sales director Ryan Kloppe said strong results from the winter boat shows and good early spring weather contributed to the sharp gain in March sales.

“This is probably just a lull,” he said of the April results.

Pointing to the four-month 2016 sales trend, Kloppe said the percentage gains in the main segments and industrywide are “even a bit higher than we were projecting for the year.”

“Six to 8 percent growth is very sustainable,” he added.

The only high-volume category in the main segments that showed an increase in April was aluminum pontoons, whose robust gains have helped lead the industry back from the Great Recession.

Click here to read March 2016 Brokerage Boat Sales Report.

Pontoon sales rose 5.1 percent to 3,349 and they are up 12.7 percent at 8,583 for the year through April in the early-reporting states.

“Aluminum fishing boats and 11- to 50-foot fiberglass outboard boats will sell more units than [pontoons] do, but you’ll still see strong growth in that segment throughout the year, I believe,” Kloppe said.

Small-to-mid-size outboard fiberglass boats were the top sellers for the month, but the 4,113 sales represented a slight 1.3 percent decline from the same month last year. The aluminum fishing boat category had a similar decline of 1.5 percent to 3,402.

The cruiser and ski-and-wakeboard categories were the only other ones in the main segments that showed a gain, but the increase in the low-volume cruiser segment was just four boats to 111.

The ski-and-wakeboard segment was up six boats to 614. Ski and wake sales are up 13.7 percent, or 207 boats, at 1,721, through April in the early-reporting states.

“The last few years we’ve seen that segment climb up and I think we’ll see it climb through double digits throughout this year, as well,” Kloppe said.

The only other industry category that showed a gain was personal watercraft, where sales rose by five units to 3,519.

Sales of 14-30-foot sterndrive boats were down 1.6 percent at 851 in April, but the recovering category is up 4.4 percent, or 101 boats, at 2,382 through April in the early-reporting states.

Sales in April 2015 were solidly higher than in the same month of 2014. Growth of 6 percent in the main segments and 8 percent industrywide included gains of 24 percent in Michigan, 23 percent in Florida and 21 percent in Minnesota as buyers took advantage of favorable early-season weather. Pontoons were by percentage the top gainer last April as well.

This year, Florida led the nation with 2,905 April sales, but that was down from 3,366 last year. Texas ranked second with 2,181 sales, down from 2,230 a year earlier. Michigan, at 2,043 (up from 1,879 last year), New York, at 1,188 (up from 974 last year) and North Carolina, at 1,150 (up from 1,086 last year) completed the top five.

The rest of the top 10 states were Alabama at 1,078 (down from 1,123); Tennessee at 763 (down from 768); California at 716 (up from 625); Washington at 655 (up from 565); and New Jersey at 642 (up from 563).

The Coast Guard was up to date in its reports on documented vessels, providing complete figures in the bigger-boat categories. Sales of 41- to 65-foot yachts fell by 12 to 79 and sales of 66-foot and larger semicustom and custom yachts fell by nine to 11.

Jetboat sales fell by 35, or 9.1 percent, to 349. Sailboat sales fell by 43 to 153.