- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Catamarans

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Lekker Boats

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- Mazu Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- MJM Yachts

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Numarine Yachts

- Ocean Alexander Yachts

- Ocean King

- Offshore Yachts

- Outer Reef

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

June 8, 2016 8:41 am

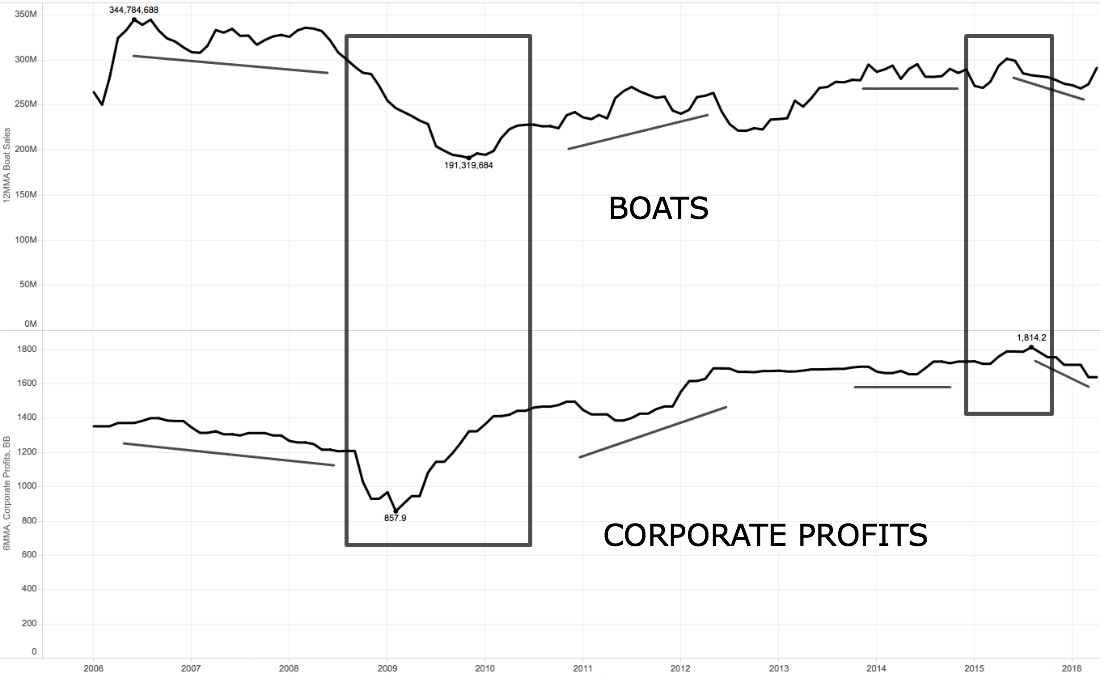

For the newest installment of our market data analysis series, we analyzed the relationship between boat sales and U.S. corporate profits. We used data from the FRED Economic Database, which aggregates the profits of all U.S. corporations – we computed the 6-month average from 2006 to 2016:

The lowest points of both graphs are in 2009, reflecting the effects of the recession, but the highest are in the opposite parts of the timeline. That means corporate profits recovered much faster than boat sales. In general, the two metrics are well correlated and we can conclude that boat sales depend heavily on the well-being of the economy. Overall, the corporate profit data is a good predictor for a long-term forecast of boat sales.

Stay tuned as we continue to share our Boat Data Analysis findings in upcoming posts.