- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Catamarans

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Lekker Boats

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- MJM Yachts

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Numarine Yachts

- Ocean Alexander Yachts

- Offshore Yachts

- Outer Reef

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

Rebounding Housing Market Spurs Florida Boat Sales

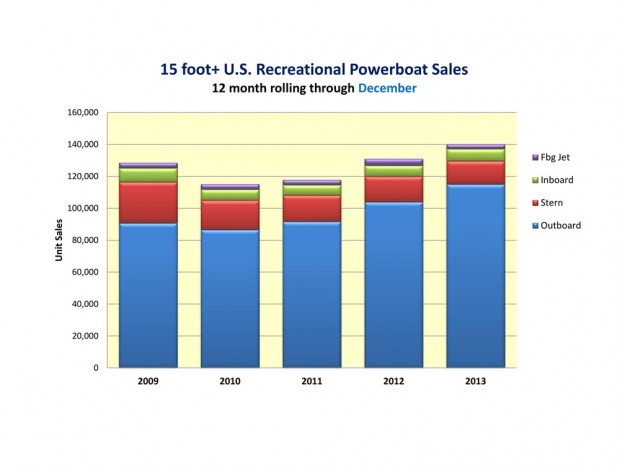

New-boat sales in December tracked largely with expectations, rising from about 120,000 units sold in 2012 to 140,000 units in 2013 on a 12-month rolling basis, a trend one industry analyst attributes in part to the rebounding housing market in Florida.

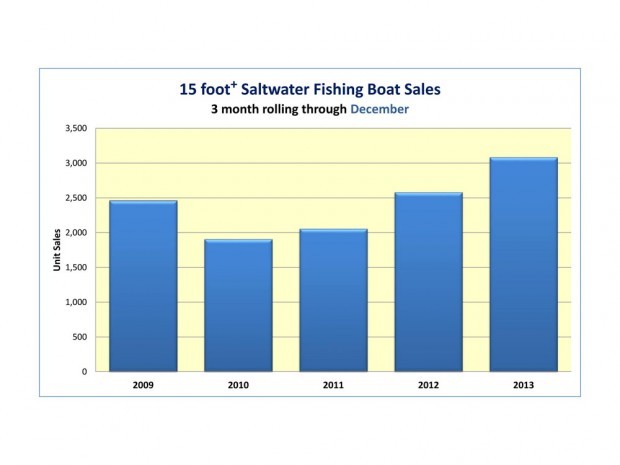

That real estate rebound might also explain why saltwater fiberglass fishing boats have enjoyed a steady climb since 2011, a rise that has continued throughout the typically slow winter months, since Floridians make up the bulk of December new-boat sales.

“Certainly sales are up again in December, but you’re talking about a month that is 2.5 percent of annual sales and most of that is in Florida and Texas,” Info-Link Technologies managing director Jack Ellis told Trade Only Today. “To say the industry did well in December is not incorrect. It just doesn’t have a lot of bearing on the overall industry.”

This year, about 6,000 boats above 15 feet were sold nationwide in December, “so it’s not like it’s a totally insignificant number of boats,” Ellis said. “But it’s 6,000 out of a quarter million.”

Certain types of boats are faring better on a year round basis — notably saltwater fishing boats, Ellis said.

“The reason I think they’re doing better is because Florida, by far, is the big market this time of year and Florida has gone through a pretty big rebound this year in terms of boat sales,” Ellis said. “I think the rise in sales is a reflection of the improvement of the real estate market in Florida.”

Lesley Deutch, senior vice president at John L. Burns Real Estate Consulting, which advises builders, hedge funds and other investors, specializes in the Florida market.

In a November interview with the Chicago Tribune, Deutch reflected on her 14 meetings and 20 community visits around the state, saying land prices and home values are rising rapidly. An increase in building has occurred in areas such as Orlando, and southwestern Florida is seeing another retiree boom.

“One of the things we’ve seen over the years is a fairly strong correlation between home sales and boat sales,” Ellis told Trade Only. “Most people have much of their equity and net worth tied up in their home. When you see the value of your home get cut by 30 percent, which happened in certain parts of Florida,” people are less likely to spend.

“I think, in general, people are feeling more comfortable nationwide, but they’re certainly feeling more comfortable in Florida,” Ellis said.

With all the buzz around aluminum fish and pontoon boats, one segment that has been overlooked is the saltwater fiberglass fishing boat segment, Ellis said. Though a relatively small part of the overall market, the segment has taken off since late 2011, when Florida first began to see an easing in the housing devastation inflicted by the 2008 bust.

But in just two years, the segment has seen a 35 percent increase in sales, Ellis said, nothing to sneeze at when sterndrive sales are still declining. In 2011, roughly 14,500 saltwater fishing boats were purchased, Ellis said. (All data refer to boats 15 feet and larger.) In 2013 that number rose to more than 19,500.

“If you look at the bellwether report [Info-Link] sent out yesterday, it looks like in late 2011 the sportfishing market turned the corner and really took off,” Ellis said.

An Info-Link graphic of the United States showed that the bulk of the segment’s sales in October through December were in Florida, unsurprising because the season is year-round, Ellis said. There were 1,107 sold in that state, followed by 529 in Texas and 413 in North Carolina.

All states except for Tennessee showed that the segment is growing and not declining, a phenomenon Ellis said is rare. “Usually when we look at these there’s a mixture of red and green,” reflecting a decline in some states and growth in others. “Right across the board, we see saltwater fishing boat sales are increasing.”

Ellis speculates that the reason for the boom is because saltwater anglers are a passionate bunch that didn’t migrate to less costly aluminum fish or pontoon boats.

“We’ve heard all the talk about a shift from the higher-content, higher-priced fiberglass boats to the slightly less expensive aluminum pontoon boats, but you don’t have that choice if you’re going offshore fishing,” Ellis said. “Rather than losing the customers to some other segment, they just put off the purchase — especially down here in Florida with the housing crisis. I think they just said, ‘We gotta wait this out,’ but they definitely seem to be buying boats again.”

Source: TradeOnlyToday

Latest News & Events

|

80′ Lazzara 2004 Sold by Will Noftsinger [ALWAYS BAREFOOT]ALWAYS BAREFOOT, an 80′ Lazzara built in… |

|

Stuart Boat Show 2025 [Boats On Display]Boats For Sale in Stuart, Florida The Stuart Boa… |

|

85′ Princess 2023 Sold by Aleks Taldykin & John Dwyer [RAW BAR]RAW BAR, an 85′ Princess built in 2023, wa… |

|

102′ Alpha Yachts 2022 Sold by David Johnson [VIVACE]VIVACE, a 102′ Alpha Yachts first delive… |

|

86′ Sunseeker 2019 Sold by Jason Walton [GALLIVANT]GALLIVANT, an 86′ Sunseeker built in 201… |

|

112′ Hakvoort 1990 Sold by Bruce Schattenburg, Scott LaCroix, Russ Schafer, & Drew Offerdahl [TEMPO REALE]TEMPO REALE, a 112′ Hakvoort built in 199… |

|

Outer Islands of the Seychelles: Close EncountersThe Outer Islands of the Seychelles are like the… |

|

94′ Ferretti 2001 Sold by Will Noftsinger [DREAMCHASER]DREAMCHASER, a 94′ Ferretti built in 200… |

|

86′ Nordhavn 2010 Sold by Alex G. Clarke [SOLACE]SOLACE, an 86′ Nordhavn built in 2010, wa… |

|

Explorer Yacht Scintilla Maris: Sea of DreamsErik Vonk, owner of Scintilla Maris, describes… |

|

Marina MandateOnce only a second thought, marinas are now a pro… |

|

86′ Princess 2024 Sold by Max Parker [TBANK III]TBANK III, an 86′ Princess built in 2024,… |